Devolution and Transmission

3. Transmissions on death prior to 1st June 1959

4. Transmissions on death on or after 1st June 1959

5. Transmissions on death of person entitled but not registered as full owner

1. Devolution

1.1 Devolution prior to the 1891 Act Prior to the Registration of Title Act, 1891, only the Personal Estate of a deceased person devolved on and became vested in his personal representative. The personal estate included Chattels Real, i.e. leaseholds and tenancy interest.

The Real Estate of a deceased person, that is his freehold property, did not devolve on the personal representative but passed directly to the devisee under a Will, or in the case of an intestacy to the heir at law, subject to estates of Dower in favour of a Widow and Curtesy in favour of a Widower.

1.2 Under Part IV Registration of Title Act, 1891

1. Part IV of this Act provided that freehold registered land at anytime sold or conveyed to or vested in a purchaser under the Land Purchase Acts, would devolve on and become vested in his personal representative (Section 84) and descend as if it were personal estate (Section 85).

2. Demesne Lands vested under the Land Purchase Acts also became subject to Part IV of the 1891 Act if there was a registered owner thereof alive on or after the 9th August 1923, (Section 60 Land Act, 1923).

3. Freehold registered land at any time purchased by means of an advance under the Small Dwellings Acquisition Acts, 1899-1931, became subject to Part IV of the 1891 Act if there was a registered owner thereof alive on or after the 15th December 1942 (Registration of Title Act, 1942, Section 19).

1.3 Administration of Estates Act 1959 This Act provided (in Section 6) that Real Estate of a deceased person dying on or after 1st June 1959, would devolve on and become vested in his personal representative. The Act did not alter the manner of devolution of the beneficial interest in freeholds.

1.4 The Succession Act This Act which came into operation on 1st January 1967, repealed and re-enacted the Administration of Estates Act, 1959, by providing in Section 10 that the Real and Personal Estate of a deceased person shall devolve on and become vested in his personal representative.

Section 12 provided that hence forth realty would descend in the same manner as personalty.

The Act substantially altered the manner of distribution on death intestate (Part VI) and provided a legal right for the spouse of the deceased person which could not be defeated by his will (Section 111) and an obligation to provide for his children (Section 117).

1.5 Devolution Notes No Devolution note is to be entered on leasehold folios.

On freehold folios bearing a devolution note which does not refer to Part II of the Succession Act, where ever a Settling Officer is satisfied that there was a registered full owner alive on or after 1st January 1967, such devolution note should be altered to read:

” The Devolution of the property is subject to the provisions of Part II of the Succession Act, 1965.”

Where the registered owner is a limited owner the existing devolution note is not to be amended unless the Legal Officer is satisfied that a registered full owner or a person entitled to be registered as full owner was alive after the 1st January 1967.

2. Personal Representatives

2.1 Assents by Personal Representatives The Administration of Estates Act, 1959, gave the power to the personal representative to vest any land of a deceased person dying testate or intestate after 1st June 1959, in the person entitled thereto by means of an assent in writing (Section 20) and authorised the Registrar to register the person named in such assent (Section 22(3)).

Prior to the Act an assent was not effective to pass an interest in land and was appropriate only in the case where a devisee was to be registered. (The interest passed by virtue of the devise). In any other case a transfer from the personal representative was required only where the personal representative was beneficially entitled (where the interest was already vested in him/herself).

The above provisions were re-enacted by Section 61 of the ROT Act, 1964, (Section 61(1) and Section 61(3)(b) in relation to transmission of registered land from limited owner repealed by the 2009 Act) as amended by Section 54 of the Succession Act, 1965 which provided in addition that, in the case of an application accompanied by an assent in the prescribed form:

“it shall not be the duty of the Authority, nor shall it be entitled to call for any information as to why any assent or transfer is or was made, and he shall be bound to assume that the personal representative is or was acting ………… correctly and within his powers”.

2.2 Registration of Personal Representatives as full owners with Inhibition

(i) When a dealing is lodged on a folio that contains an inhibition, entered at the time of a Land Commission First Registration, restricting all dealings by the registered owner of the folio except in the administration of the estate of some deceased person, the said dealing is to be passed to the Higher Executive Officer for attention. The Divisional Manager may be consulted where necessary.

(ii) There is no provision in the Registration of Title Act, 1964, or the Land Registration Rules, 2012, for the registration of a personal representative as full owner with an inhibition inhibiting dealings with the property except in the administration of the estate of the deceased person.

The Act or the Rules do not prohibit such registration, but such registration should not normally be made since the note of death procedure provided by the Rules is adequate.

In rare cases it may be necessary to make such a registration e.g. where the Court directs or in certain Section 49 applications.

(iii) Prior to 1959 personal representatives of deceased registered owners were registered as full owners with an inhibition inhibiting all dealings except in the administration of the estate of the former registered owner.

Where a personal representative so registered is the executor of the former registered owner his registration does not prevent him from assenting to the devise. He may either assent to the devise or transfer the property to the devisee.

If an executor so registered died testate before the 1st January 1967, and has appointed an executor who proves his will, such last mentioned executor can, as personal representative of the original registered owner, proceed with administration of the estate by sale, transfer or assent, etc.(See heading 2.6 hereunder).

(iv) Where a personal representative so registered dies before completing the administration and chain of executorship does not arise the following practice is to be adopted on lodgment of a dealing:-

(a) If the inhibition entered on the folio is against all dealings except a transfer on sale without notice to persons beneficially entitled a grant de bonis non or an order under Section 61(7) of the Registration of Title Act, 1964, is not to be called for. The inhibition was often entered in this form where the property had been devised to the personal representative on trust to sell. The Grant to the deceased personal representative is to be accepted and notice served on the persons named in the inhibition. If the registration of the personal representative is more than 12 years old, the present addresses of the notice parties should be ascertained. If some of the notice parties are deceased the names and addresses of their personal representatives or the persons entitled to their assets is to be requisitioned and notice served on such persons. If the dealing lodged is a sale by the personal representative of the deceased personal representative registration is to proceed after service of notice on and in default of objection by the parties named in the inhibition or their representatives. If the dealing is not a sale the Divisional Manager should be consulted before proceeding with the registration.

(b) If the inhibition entered on the folio is against all dealings except in the administration of the estate of the former deceased registered owner a grant of administration de bonis non must be extracted or an order under Section 61(7) of the Registration of Title Act must be obtained. A Grant to the registered personal representative is not necessary. The Administrator de bonis non may complete the administration in the normal manner.

(v) Where a personal representative, whether registered as owner or not was beneficial owner also but died without having executed an assent in writing in his/her favour a De Bonis Non grant is required to be lodged together with the assent of personal representative appointed therein. The decision in the case of Mohan-V-Roche 1991 I.R. p.560 involved unregistered land and does not appear to apply to registered land, see paragraphs 21 and 33 Catherine Dolan v James Reynolds [2011] IEHC 334, Abbot J, 11th February 2011 and paragraphs 34, 35 and 37 of Trentdale Limited v O’Shea [2018] IEHC 47, Creedon J, 25th January 2018.

2.3 Notes of Death The Administration of Estates Act, 1959, provided for the devolution of all property on the personal representative.

Accordingly, on the death after the 1st June 1959, of the registered owner of any property, his death may be noted in accordance with Rule 92 of the Land Registration Rules, 2012.

The PRA will enter a note of death under Section 61(6)(b) of the Registration of Title Act 1964 on its own initiative under the following circumstances

(i) Where a transmission of part of a folio is registered and the residue of the folio is not administered a note of death of the registered owner will be registered on the parent folio.

(ii) Where a transfer on sale by a personal representative of part of a folio is registered and the residue of the folio is remaining in the name of the deceased owner a note of death of the deceased registered owner will be registered on the parent folio.

2.4 Sales by Personal Representatives The personal representative may sell property which devolves on him as personal representative. The purchaser is protected by Section 51(1) of the Succession Act 1965.

Generally, in such a sale it is not the duty of the Registry officials to consider the adequacy of the consideration. Even in a sale by the personal representative to himself; or when privileges or burdens are reserved to the personal representative or other, the duty of the registering authority is to give effect on the Register to the transfer and burdens.

However, if the consideration is clearly nominal, the transfer is prima facie not in due course of administration. A purchaser is defined in the Succession Act 1965 as “a grantee, lessee, assignee, mortgagee, chargeant or other person who in good faith acquires an estate or interest in property for valuable consideration”. Section 3 of the Land and Conveyancing Law Reform Act 2009 states that a nominal consideration in money is not valuable consideration. Therefore, a transfer by a personal representative, which includes a small nominal consideration, cannot be construed as a sale by the personal representative in due course of administration. Neither is such a transfer acceptable as a prescribed form of transmission on death to the person entitled.

In the case of a death intestate between 1st June 1959, and 1st January 1967, where the devolution of the property was not subject to Part IV of the 1891 Act, and a right of Dower arises in favour of the widow, her concurrence should apparently be sought (See Re. McMackin I.R. 1909 Page 374, also articles in the Irish Law Times and Solicitors’ Journal, 1925, Page 9, and the Irish Law Times and Solicitors’ Journal, 1938, Page 115, Williams – Vendor and Purchaser Vol. 1 Page 218).

2.5 Leases by personal representatives Leases by the personal representative of the deceased registered owner are to be accepted for registration without question (See Section 60 of the Succession Act, 1965).

2.6 Chain of Executorship Prior to the Succession Act, 1965, the executor of a sole or last surviving executor was the executor of the original testator. Because of Section 19 of the Succession Act, such a chain does not arise in the case of an executor who died after 1st January, 1967. However, it continues to apply in respect of an executor who was such by reason of a chain of executorship arising before the Succession Act came into operation, i.e., where the executor whose death created the chain died before 1st January, 1967.

2.7 Proving Executors Where probate is granted to one or some of several persons named in the Will as executors, whether or not power is reserved to the others to prove, the proving executors alone may exercise the powers of a personal representative.

On the death of the last proving executor, a dealing by a surviving executor who has not proved is not to be registered unless and until he produces a grant to his testator. Glover’s conclusions from the case of Cummins v Cummins (8 Ir. E.R. 723-736) are to be disregarded.

2.8 Where personal representative is a Company Where the personal representative is a company or corporation such as a Bank the person authorised by the company or corporation to swear affidavits on behalf of the company or corporation may swear affidavits for registration purposes. If they divest themselves of the property by the assent or transfer, such assent or transfer must be under seal of the company or corporation.

2.9 Personal Representatives as Trustees It is to be noted that in cases where the property of a deceased owner vests in his personal representative, while the latter is not an express trustee for the persons beneficially entitled, he is a trustee, and all incidents of trusteeship including a sale to himself of the property attach to his office.

However, on sale by a personal representative to himself whether or not through a nominal trustee, registration should proceed after notice to the beneficiaries if they are all sui juris.

2.10 Trustees of Infants share appointed by personal representative Where an infant is entitled to a share in the estate of a deceased person and there are no trustees able and willing to act, the personal representative of the deceased may appoint a trust corporation or two or more persons to be trustees of the share of the infant and may vest the property in the trustees. In default of appointment the personal representatives are trustees (Section 57 Succession Act, 1965).

Where an infant becomes entitled on intestacy a settlement is deemed to exist and the trustees under Section 57 are trustees for the purposes of the Settled Land Acts (Section 58(2) Succession Act, 1965).

2.11 Grants of Limited Duration If a grant of representation is of limited duration e.g. during the minority of a person, the Settling Officer must be satisfied that the grant was in full force and effect at the date of execution of assent or transfer. A certificate to this effect from the Solicitor may be accepted.

2.12 Impounded Grants If a grant of representation is impounded by the Probate Office the operation of the grant while so impounded is suspended. No registration on foot of the grant is to be carried out unless and until the grant is lodged in the Registry in the normal way. The registration is not to be carried out as a result of inspection of the grant in the Probate Office.

2.13 Dispensing with Raising Further Representation The Court has power under Section 61(7) Registration of Title Act, 1964, to dispense with the raising of further representation to a deceased registered owner in certain circumstances.

An application under the Subsection is made by Notice of Motion and supporting affidavit, which, bearing appropriate Land Registry Stamps, are lodged with the Land Registry’s Court Registrar in the case of proceedings in the High Court or with the County Registrar in the case of proceedings in a Circuit Court.

3. Transmissions on death prior to 1st June 1959

3.1 Freehold property not subject to Part IV Registration of Title Act 1891 Such property does not vest in the personal representative since the Administration of Estates Act, 1959, does not apply to it.

It appears, however, possible that a personal representative could appropriate such property under Section 55 and 56 of the Succession Act, 1965. If an application containing same is lodged for registration the case is to be referred to the Deputy Registrar for decision.

Transmissions on intestacy of such property are subject to the Rules of Law and Canons of Descent which relate to property which descend as realty before 1st June 1959, and are to be dealt with in accordance with Rule 85(1). The rights of Dower and Curtesy still remain to be considered in such cases. The application by the heir at law should be in Form 33 adapted to the facts of the case.

In the case of deaths testate (Rule 85(1)):

(i) If the original Will is lodged, the Solicitor is not to be directed to extract a grant. Reference is to be made to the Divisional Manager for his/her direction of the necessary proofs. The Settling Officer should satisfy him/herself from a reading of the Will that the statements in Form 33 are in accordance with the Will. The registration must be in accordance with the legal effect of the devise. The application by the person entitled should be in Form 33 adapted to the facts of the case.

(ii) Where the Will has been proved and at the date of lodgement of the dealing there is no personal representative available by reason of death or otherwise, a dbn (de bonis non) Grant is not to be called for, and the devisee is to be registered, unless the property is charged by the Will with the payment of debts or the Will contains a general charge on it for the payment of legacies which are primarily payable out of the personal estate. Where the property is so charged the matter is to be referred to the Divisional Manager.

(iii) In the case where the Will contains a charge which is payable solely out of the registered land, i.e. when the land is charged in exoneration of the personal property, and no reference to same is made in the application, or no assent to its registration as a burden by the devisee is lodged, the Solicitor should be asked to show that it no longer subsists or to lodge an assent to its registration as a burden. An affidavit by the Personal Representative, in Form 34 suitably adapted, may be accepted as proof that the charge in question does not affect the lands.

3.2 Property subject to Part IV of the 1891 Act and Leasehold Property

(i) The application must be accompanied by the Grant to the estate of the deceased registered owner, or an official copy thereof.

(ii) The application should be grounded in Form 33 accompanied by an affidavit of the Personal Representative in Form 34

(iii) All Deeds and proofs, showing the applicant’s entitlement, must be listed in Part 1 of the Schedule of Form 33 and lodged with the application.

(iv) In the case of testacy the Settling Officer must read the Will and satisfy him/herself that the statements in the Forms are in accordance therewith. The registration must be in accordance with the legal effect of the devise unless an appropriation is made under Section 55 or 56 of the Succession Act, 1965. If an appropriation is made by the personal representative the case should be passed to the Divisional Manager for a direction.

Where the Will charges the realty with the payment of debts and legacies that are primarily payable out of the pure personality and the Form 34 contains an averment by the personal representative that s/he makes no claim against the property for any sum for payment of the debts and/or legacies charged thereon that are payable primarily out of the testator’s personal estate, the application is to be accepted without any inquiry and registration of the devisee is to proceed without regard to the legacies and/or debts. If the application does not contain such averment the matter should be raised with the Solicitor.

(v) In case of intestacy, all distributive shares must be accounted for. In any case, where a distributive share or shares does not appear to be accounted for, the matter should be referred to the Divisional Manager for a direction.

It is to be noted that the personal representative has power to appropriate under Section 55 or 56 of the Succession Act, 1965, but if such appropriations are made, a transfer must be used and lodged with the Forms 33 and 34.

(vi) In the case of successive deaths, that is where the person who became entitled on the death of the registered owner has died and the application is made by his/her successor in title, an affidavit by the personal representative of the second (and any subsequent) deceased in Form 34 is also required, dealing with the funeral and testamentary expenses, etc of such owner and setting out the persons becoming entitled to any interest on that death.

Example: A, the registered owner, dies prior to 1st June 1959. B becomes entitled on his death. B dies and C becomes entitled on his death.

Our requirements are:-

1. Grants to A and B.

2. Affidavit in Form 34 by personal representative of A.

3. Affidavit in Form 34 by personal representative of B.

4. Application in Form 33 by C

5. Documents showing entitlement of C

(vii) In cases where the personal representative of the Registered Owner has died before completing the administration of the estate, it is usually necessary to extract a Grant d.b.n. (de bonis non) to the estate of the registered owner, i.e. a grant to deal with the assets left unadministered by the first personal representative. In suitable cases, however, it may be more convenient for the applicant to seek an order of the Court under Section 61(7) of the Registration of Title Act, 1964, to dispense with the necessity to raise further representation, or to make an application under Section 49 of the Registration of Title Act, 1964, on the basis that s/he has by possession of the lands barred the interest of any other person therein.

(viii) In any case where it is claimed that shares or interests are statute barred the matter should be passed to a Higher Executive Officer.

3.3 All future interests in land whether vested or contingent exist in equity only. The freehold legal title will vest in the trustees to be held in trust for the beneficiaries under Part 4 of the 2009 Act.

3.4 Whether legacies charged on land The general personal estate is the primary fund for the payment of funeral and testamentary expenses, debts and legacies. Every devise of land is specific (Forrester v. Leigh, Ambl. 173) and like a specific legacy is not liable for the general legacies if there is a deficiency in the general personal estate, unless they are charged on it.

A bequest, however, of legacies or annuities followed by a gift of the residue of the real and personal estate in one mass charges the legacies or annuities on the real estate included in the residue: Greville v. Brown 7 H.L.C. 689.

But a provision in a Will charging debts or legacies on land is evidence, not that the personal estate is exempted from them but that the testator intended that the land should be an auxiliary fund for their payment to the extent to which the personal estate is insufficient for the purpose; they are, therefore, only raisable out of the land after the general personal estate is exhausted; Rhodes v Rudge Sim. 84, 85; Re. Ovey 31 Ch. D. 113; unless, of course, a testator charges his real estate with his debts or legacies in exoneration of his personal estate, but the intention to do this will only be inferred if the language of the Will is such as to show that he meant, not merely to charge the real estate but so to charge it as to exempt the personal estate; Bottle v Blundell 1 Mer iv. 219. The inclusion of the Realty nominatim (designated by name or one by one) in a residuary devise is not a specific devise.

4. Transmissions on death on or after 1st June 1959

The application must be

(i) Strictly in the prescribed form

(ii) Accompanied by assent of the personal representative strictly in the prescribed form, and

(iii) Accompanied by the Grant or an official copy there of Alternatively: A Transfer from the personal representative in the prescribed form accompanied by the Grant.

The lodgement of the Grant is required solely for the purpose of proving who the personal representative is.

The assent is effective to vest any property in the person entitled (Section 20 Administration of Estates Act, 1959; Section 52 Succession Act, 1965).

The Settling Officer is concerned solely with the assent. S/he is not to read the Will or any settlement made by beneficiaries; releases by next of kin are not to be considered. All such documents are to be returned on completion of the registration.

If it appears prima facie that the personal representative is not acting in due course of administration the registration directed by the assent or transfer is to be carried out without service of notice on any person. The remedy of the persons beneficially entitled and of creditors is to take proceedings in Court for the administration of the estate against the personal representative or his/her bondsmen if any.

If the assent shows that a registration sought would be illegal or unauthorised the Settling Officer is not to carry out such registration.

Where the assent of the personal representative or application discloses an obvious error of law or fact e.g. the consent to the entry of an inhibition to protect a total restraint on alienation, or a transfer by a personal representative for natural love and affection, the matter should be taken up with the Solicitor on the facts disclosed in the assent only.

In all other cases the Settling Officer is to carry out the registration of ownership and burdens as required by the assent.

If it is disclosed that the applicant is entitled by virtue of an appropriation (under Section 55 or 56 of the Succession Act, 1965) notice is not to be served on any person in respect thereof.

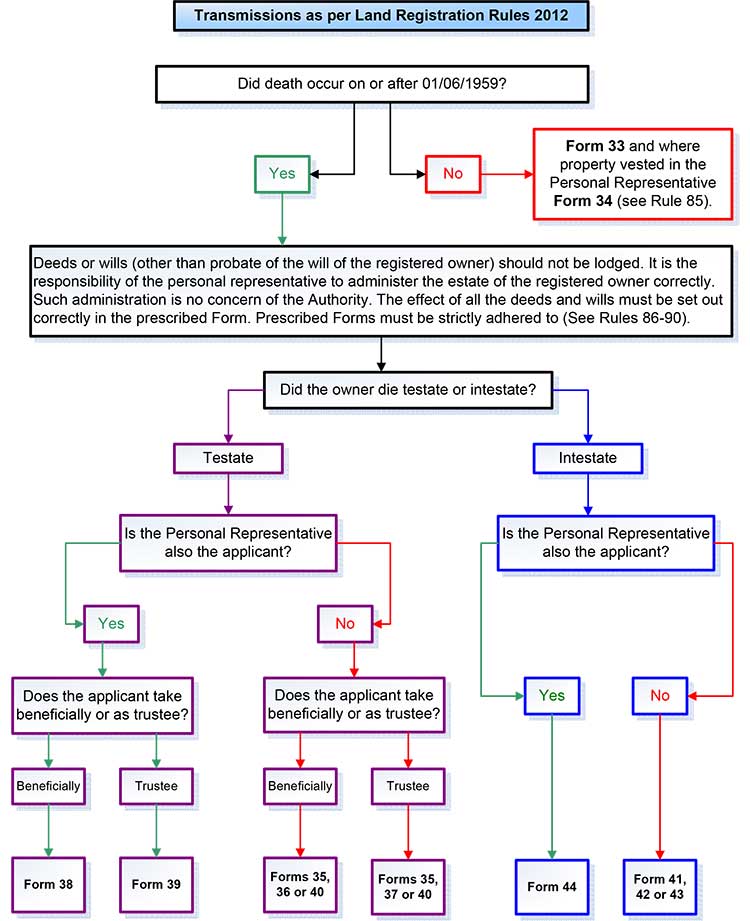

The prescribed forms in any given case may be quickly ascertained by reference to the Chart in the Appendix hereto.

5. Transmissions on death of person entitled but not registered as full owner

Rule 90 prescribes the forms to be used in the case of a transmission on the death of a person, who at the time of his/her death was entitled to be registered as full owner. It is doubtful whether the provisions of Section 61(3) of the Registration of Title Act 1964, as inserted by Section 54(2) of the Succession Act 1965, apply to such transmissions.

If, therefore, the person so entitled died on or after the 1st June 1959, an affidavit in Form 34, from the personal representative, is required in addition to the proofs prescribed by such of the Rules 86 to 89 as govern the transmission on death of the registered owner.

If it appears doubtful whether the dealing is in due course of administration, the duty of the Settling Officer is confined to the serving of notice on the persons beneficially entitled and appearing to be prejudiced by the transaction.

6. Withdrawal of Name – Application for registration by survivor(s) of Joint Tenants

(1) General

At common law, on the death of a joint tenant, the property automatically passes to the surviving joint tenant(s) under the laws of survivorship. Rule 94(1) of the Land Registration Rules 2012 provides for the withdrawal from the Register of the deceased’s name on proof of his/her death.

(2) Act/Rules Commonly Recited

- “the 1964 Act” –The Registration of Title Act, 1964.

- “LR Rules” –Land Registration Rules 2012 (S.I.483/2012).

(3) Requirements

The application should be:

(a) On affidavit in Form 47 of the Land Registration Rules 2012 (seeAppendix 2). (b) Accompanied by proof of death. (c) CompletedForm 17 (d) Land Registry Fees of €40.00.

(4) Proof of Death

The death of the joint tenant may be proved by lodging any of the following (Rule 94(2) Land Registration Rules 2012 refers):

(a) Original or Office Copy of the Grant of Probate/Letters of Administration. (b) Original Death Certificate. (c) Original Memorial Card. (d) Such other proof as the Registrar may deem sufficient.

(5) Miscellaneous

Where there are no surviving joint tenants, the Affidavit should be made by the Personal Representative of the last surviving joint tenant. The Grant of Probate/Letters of Administration of said tenant will be required.

(6) Final Checklist

Form 17. Appropriate fee. Affidavit. Proof of Death.

(7) Registration Procedure

The existing ownership entry is to be cancelled. A New Entry is to be added to the Folio which includes ALL of the surviving joint tenants. The date of registration is the date of lodgement and both the old and new Instrument Numbers are added to the Instrument Field (in chronological order). The following is to be added to the Notes of the New Entry:

“NOTE: The previous joint ownership entry has been altered (New Date & New Instrument)”.

________________

Originally published 30 November 2009 Paragraph 2(2)(v) updated 9 October 2018 Paragraph 2.3 Note of Death amended 13 March 2019

John Murphy

Deputy Registrar.

Appendix 1:

Transmissions Flowchart